- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

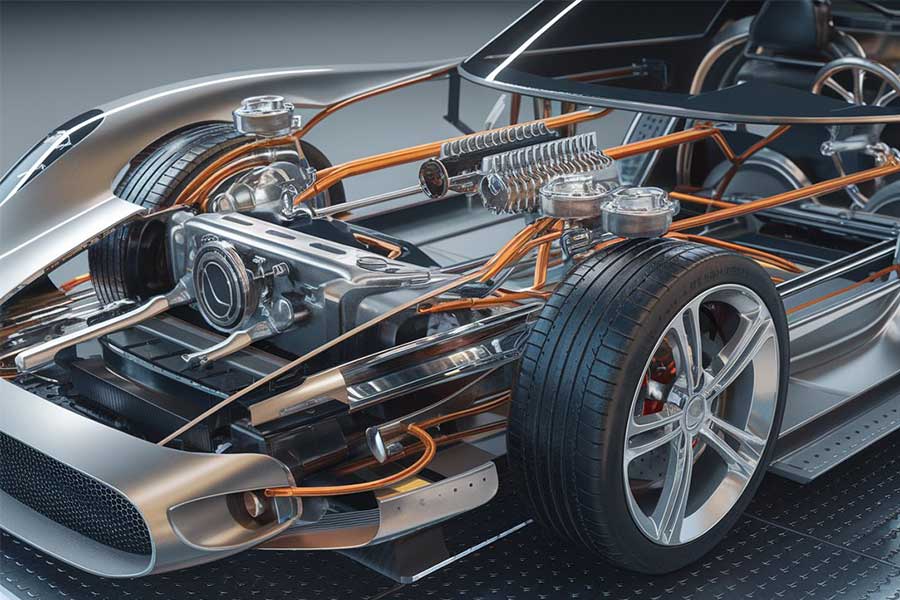

Professional Analysis:Automotive partsImport RepresentationFull Process Service & Industry Trends

—— 20 yearsforeign tradeIn-Depth Insights from Agency Practitioners

Contents

ToggleIntroduction: Import Parts Demand Under Chinas Auto Industry Upgrade

In recent years, as Chinas auto market transitions toward premium andNew energytransformation, demand for imported auto parts continues growing. Statistics show Chinas auto parts imports exceeded $30 billion in 2023, with significant increases in NEV core components, smart parts, and premium model-specific parts. Yet complex customs policies, technical certification barriers, and supply chain risks create major challenges for direct imports. Drawing on 20 years industry experience, this article systematically analyzes the core value and operational essentials of auto parts import agency services.

I. Industry Pain Points & Agency Service Value in Auto Parts Imports

1.High Supply Chain Risks

- Technical Barriers: EU REACH Environmental Certification, US DOT Standards, China3Ccertification technical barriers causing clearance delays;

- Logistics Fluctuations: Global automotive supply chain restructuring post-chip shortage,Maritime TransportationTight shipping space and port congestion become the norm;

- financial pressure: High-value components (e.g. ECU control modules, high-voltage battery packs) tie up substantial working capital.

2.Core Advantages of Agency Services

- Compliance guarantee: Anticipate HS code classification disputes in advance (e.g. 8708 mechanical parts vs 8537 electronic components);

- Professional support: Reduce overall logistics costs by 15%-30% through bonded warehousing in free trade zones,China-Europe Railway Expressand multimodal transport;

- Risk control: Utilize AEO advanced certification to shorten customs clearance time and avoid anti-dumping duties,It is recommended to verify through the following methods:How to ensure that bicycles exported to the United States comply with regulations and standards?

II. Complete breakdown of auto parts import agency process

1. Preliminary planning stage: Demand analysis and solution customization

- Parts classification management: Differentiate between consumables (brake pads, filters), core components (transmissions, motors) and special parts (ADAS sensors);

- Accurate tax rate calculation: For example, lithium batteries for NEVs (85076000) carry 8% import duty plus 13% VAT;

- Supplier Qualification Review: Require overseas factories to provide IATF 16949 quality system certification and RoHS compliance declaration.

2. International LogisticsCustoms operation

- Logistics solution design:

- Air Transportation: Suitable for emergency repair parts (48-hour port arrival, cost approximately 4 times sea freight);

- LCL shipping: For small/medium batches, reduce costs via transshipment through Port Klang, Malaysia or Singapore;

- Document compliance processing:

- Key verification items: Import Motor Vehicle Inspection Sheet, ECE R100 EV safety certification;

- Pre-classification dispute case: LiDAR (whether classified as 8526.91 or 9031.49 directly affects tax rate).

3. Customs clearance and domestic distribution

- Port selection strategy: Shanghai Yangshan Port (green channel for NEV parts), Guangzhou Nansha Port (Southeast Asia route hub);

- Local inspection preparation: For electronic components like ECUs, prepare EMC test reports in advance;

- Supply chain extended services: Provide VMI supplier inventory management to achieve JIT delivery to OEM production lines.

4. Industry trends and agency service upgrades

1.NEV and smart connectivity parts boom

- Annual 40% growth in imports of power battery modules, automotive chips (e.g. Infineon IGBT modules);

- New agency service: Assist companies in applying for NEV Models Exempt from Vehicle Purchase Tax Catalog.

2.Digital supply chain transformation

- Blockchain applications for parts traceability (e.g. Bosch ESP system original factory certification on-chain);

- Smart declaration system automatically matches CIQ codes (e.g. axles with drive motors require declaration under 87085042).

3.Green logistics and ESG compliance

- Promote electric heavy truck distribution,photovoltaicbonded warehouses to comply with EU CBAM requirements;

- Establish packaging material recycling systems to meet zero-waste delivery standards of OEMs like Tesla and BMW.

5. Case studies: How agency services solve corporate challenges

Case 1: German luxury brand importing air suspension systems

- Pain Points: Goods worth over $2 million stranded at port due to classification dispute, generating daily late fees of 10,000 yuan;

- Solutions: Agency team submitted Commodity Classification Dispute Application within 3 days, cited TD/T 2021-15 ruling case, ultimately classified under 8708.80 (6% duty rate), saving 420,000 yuan in taxes.

Case 2: NEV manufacturer importing thermal management systems

- Pain Points: PTC heaters produced in Mexican factory involved in USMCA rules of origin;

- Solutions: Compared RCEP and USMCA rules, selected Busan, Korea transshipment to obtain cumulative origin qualification, reducing tariffs from 12% to 5%.

Conclusion: Professional agency services empower industrial chain upgrading

Under the New Four Modernizations wave in automotive industry, import agency services have evolved from mere customs executors to strategic corporate partners. Choosing agencies with automotive industry know-how becomes key to ensuring supply chain security, reducing compliance costs, and gaining market advantages.

---: Data cited from China Customs, China Association of Automobile Manufacturers and industry research, operating standards reference 2023 Tariff Schedule and Motor Vehicle Environmental Protection Recall Management Regulations.import and exportRevealing auto parts import agency: 20-year experts in-depth analysis of complete process and future trends

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912