- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

II. Decomposition of the Whole Import Process of Inner CV Joint (Taking China as an Example)

It is necessary to accurately determine that it is classified under 8708.99 (transmission system components) to avoid tax rate deviations caused by misclassification (Most - Favored - Nation tariff is 8% and value - added tax is 13% in 2023).

III. Practical Risk Cases and Solutions

STEP 1 Pre-compliance confirmation

- HS Code locking: Mandatory Certification Verification

- ?:

(Preferential tariffs can be enjoyed under ASEAN/China - ROK FTA) It is recommended to verify through the following methods:? Certificate of non - used parts (to prevent being identified as foreign garbage)

? Non-used parts certificate (to prevent being identified as "foreign garbage")

And Document Preparation

STEP 2 International LogisticsI. Basis for inspection and quarantine

- to help enterprises reduce: For precision parts, it is recommended to use temperature - controlled containers (to prevent corrosion). A 20GP container can hold approximately 2000 sets of standard constant velocity joints.

- Core document list:

? Original commercial invoice (must indicate the material, torque value, and applicable vehicle models)

? Packing List (gross weight/net weight deviation <3%)

? Certificate of origin (preferences can be stacked under RCEP)

? Technical parameter table (including hardness, surface treatment process, etc.)

STEP 3 Declaration and inspection response

- Intelligent declaration strategy:

? Pre - classification service (apply to the customs in advance for classification ruling)

? Price declaration (be vigilant against "transfer pricing" scrutiny, provide original manufacturer procurement agreement) - High - frequency risk points for inspection:

? Material testing (needs to meet the anti - wear standard of GB/T 12609 - 2005)

? Intellectual property verification (guard against infringement of counterfeit OE parts)

? IPPC mark on wooden packaging (if there is no mark, the whole container will face fumigation)

STEP 4 Tax optimization and release

- Tariff planning plan:

? Application of free trade agreement tax rates (such asChina-Europe Railway Expresstransportation can enjoy regional preferences)

? Deferred tax policy (applicable to AEO advanced certified enterprises) - Application for special channels:

? Emergency release (a shortage certificate from the 4S store is required)

? Release on bond (can be applied for when there is a dispute over classification)

IV. Value Matrix of Professional Agency Services

Case 1: Incorrect model declaration leading to port congestion

A German brand supplier mistakenly reported "GKN-2287A" as a universal model number. Customs inspection revealed that it was actually a specialized part for the Audi Q7, triggering a valuation procedure due to the failure to declare vehicle model association information.

Solutions:

- Immediately supplement the OE number - to - vehicle model comparison table

- Provide an explanation of the original price breakdown

- Activate the emergency bond channel (reduce port congestion losses)

Case 2: Return of goods due to lack of material certificate

The constant velocity joints imported from Indonesia were suspected of not meeting the wear - resistant standard because the surface carburizing treatment process report was not issued.

Solutions:

- Urgent arrangement for third - party testing (SGS/TüV)

- Coordinate with the customs for on - site sampling and testing

- Submit a supplementary statement of compliance with the ISO 2638: 2015 standard

V. Import Trend Warning in 2024

| Service modules | Traditional operation risks | Value - added points of agency services | |

|---|---|---|---|

| Classification prediction | 30% declaration error rate | Precise matching of customs big data + industry database | |

| — | — | — | |

| Time - effect control | Average delay of 12 days | Direct connection to the customs system, 98% compliance rate for customs clearance within 72 hours | |

| Legal risk prevention | Increase in hidden costs | Full - process compliance escort by a professional lawyer team |

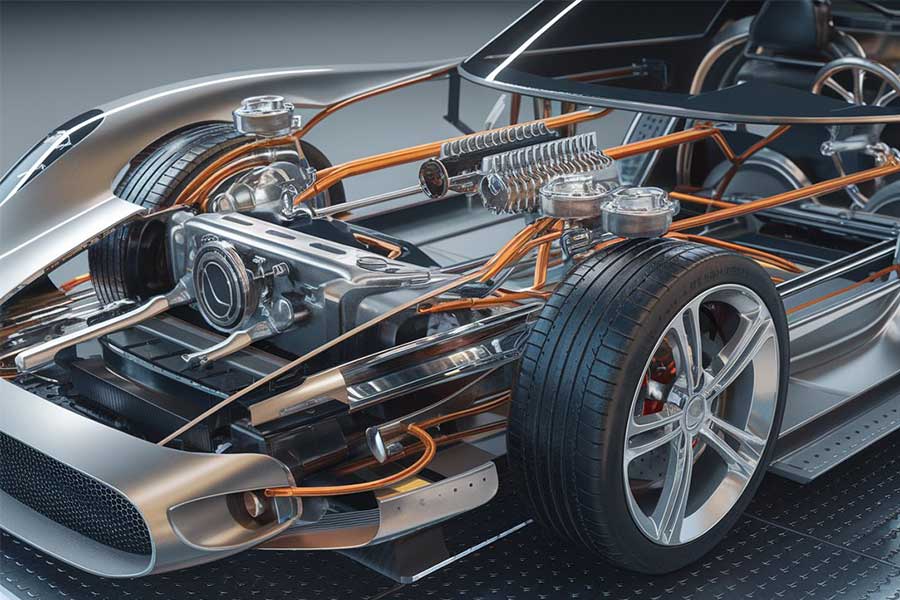

As a core component of the automotive transmission system, the import demand for Inner CV Joint (Inner Constant Velocity Joint) has been continuously increasing with the expansion of the Chinese automotive aftermarket. Data in 2023 shows that the domestic high - end vehicle maintenance market has a 65% import dependence on original factory/high - precision CV joint parts. However, due to the complex product technical specifications, many customs classification disputes, and strict certification requirements, importers often face risks such as high demurrage fees, return of goods, and even administrative penalties.

1.Strengthening of customs AI bill review: :Incomplete declaration elements will result in direct return of the bill

2.Carbon footprint certification requirements: :For EU - imported parts, carbon emission data of the production process needs to be provided

3.Upgrading of origin verification: :For goods transshipped in Southeast Asia, a complete processing procedure certificate needs to be provided

Conclusion

The import of inner CV joint components is not only a technical battle but also a compliance battle. Choosing an agency service provider with specialized qualifications for automotive parts (it is recommended to verify their AEO certification and automotive industry service case database) can reduce overall import costs by over 40%. Companies are advised to establish a trinity import management system encompassing "technical parameters - HS codes - tax planning" to secure supply chain dominance amid fierce competition.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912