- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

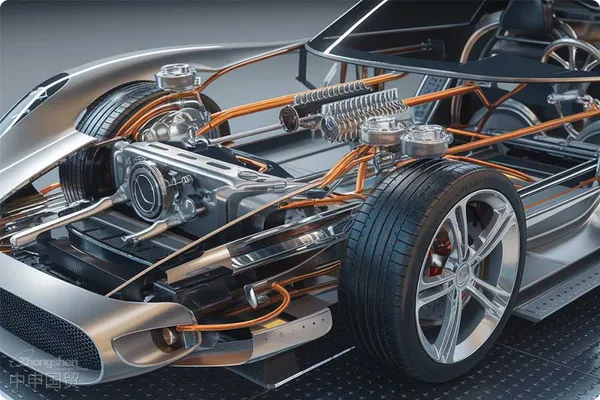

With the technological upgrading of the global automotive industry and the increasing domestic requirements for engine efficiency, turbochargers, as a core component for enhancing power performance and achieving energy-saving and emission reduction, have seen sustained growth in import demand in recent years. However, the import process involves complex customs supervision, technical standard certifications, and logistics planning, requiring enterprises to rely on the technical capabilities and service networks of professional customs brokerage firms for efficient clearance. This article is based on 20 years of import...Export RepresentationService experience, systematically organizing the key aspects of turbocharger imports and risk response strategies.

I. Characteristics and Regulatory Requirements of the Turbocharger Import Market

1.Product Technical Attributes and Classification Key Points

The turbocharger falls under the "People's Republic of Chinaimport and exportUnder Chapter 84 of the "Customs Tariff"—"Nuclear reactors, boilers, machinery and mechanical appliances," it is necessary to accurately declare the HS code (e.g., 84091000 or 84148090). Different models must be classified based on parameters such as boost pressure, applicable vehicle type (passenger/commercial vehicles), and whether they include an ECU control unit. Incorrect classification may lead to tariff discrepancies or rejection of the declaration.

2.Technical Access and Certification Requirements

- China Compulsory Certification (CCC): Some turbochargers applicable to gasoline engines require CCC certification (refer to the "Implementation Rules for Compulsory Certification of Motor Vehicle Products").

- Environmental compliance: Must comply with environmental standards such as the "Limits and Measurement Methods for Exhaust Pollutants from Diesel Engines of Non-Road Mobile Machinery," and may need to submit an emission test report upon import.

- It is recommended to verify through the following methods:Certificate: If importing from ASEAN or RCEP member countries, it is necessary to provide a FORM E or RCEP Certificate of Origin to enjoy tariff preferences.

2. TurbochargerImport RepresentationThe core challenges of customs declaration

1.Classification Disputes and Valuation Risks

Due to rapid technological iterations and complex model variations, customs valuation departments may raise doubts about declared prices. Professional customs brokers need to assist clients in organizing original manufacturer invoices, payment records, technical parameter documentation, and other supporting materials. When necessary, they should provide evidence for reasonable declarations through the "deductive value method" or "computed value method" as stipulated in the WTO Valuation Agreement.

2.Technical Documentation Compliance Review

The importer must provide complete documentation, including product manuals, material certificates, and schematic diagrams of working principles. For example, components containing precious metals (such as platinum catalysts) require separate declaration and payment of consumption tax.

3.Logistics and Time Efficiency Management

Turbochargers have high requirements for transportation shockproofing, necessitating the selection of a logistics service provider with qualifications for transporting precision equipment. Additionally, it is essential to plan in advance for bonded warehousing or direct delivery to the production line to avoid delays in inspections that could affect the supply chain.

III. Value Empowerment of Professional Customs Brokerage Firms

1.End-to-end service framework

- Preliminary pre-classification and compliance consultation: Determine the commodity code through pre-classification services (Customs code 3702) and anticipate regulatory requirements.

- Document Pre-review and Risk Screening: Review the completeness of technical documents to avoid customs clearance delays caused by "incomplete declaration elements."

- Tariff optimization plan: Utilize policies such as free trade agreements and domestic sales processing trade to reduce overall costs.

2.Emergency response capability

- Response to customs inspection: For specialized inspections of turbochargers (such as energy efficiency testing and intellectual property verification), customs brokers can coordinate with third-party testing agencies to expedite certification.

- Handling of Overstayed Cargo at Port: Alleviate financial pressure through measures such as bond release and installment payment of taxes.

IV. Classic Case Analysis

Case Background: A car manufacturer imported a batch of German-made turbochargers (including ECU control modules) and mistakenly declared them under HS code 84148090 (tariff rate 8%) during customs declaration. However, customs questioned that they should be classified under HS code 8708 (tariff rate 10%).

Solutions: The customs broker submitted the product structure diagram, ECU independent function description, and the "Customs Commodity Classification Guidance Opinion," proving that the ECU is merely an auxiliary control unit for the turbocharger. The original classification was ultimately upheld, saving the company $120,000 in taxes.

V. Key Indicators for Enterprises When Selecting a Customs Brokerage Agency

1.Industry Qualifications: Must possess AEO Advanced Certification and import qualifications for electromechanical products.

2.Technical Team: Specialist familiar with internal combustion engine principles and the customs supervision system for automotive parts.

3.Service network: Customs clearance teams are stationed at major ports (such as Shanghai Yangshan Port and Tianjin New Port) to achieve "port-local" coordinated inspections.

Conclusion

The import of turbochargers is not merely a simple logistics activity, but a systematic engineering project involving technical trade measures and compliance management. Professional customs brokerage firms, leveraging their technical analysis capabilities, customs communication experience, and resource integration advantages, can help enterprises improve clearance efficiency by over 30% while mitigating compliance risks. It is recommended that importers engage customs service providers during the supplier negotiation phase to optimize trade contract terms from the outset, achieving dual optimization of supply chain costs and efficiency.

For further details on the import documentation checklist for turbochargers, the latest tariff policies, or RCEP customs clearance practices, you may contact the author to obtain the "Turbocharger Import Operation Manual (2024 Edition)."

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912