- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Contents

ToggleThe three core challenges in the trade of imported equipment.

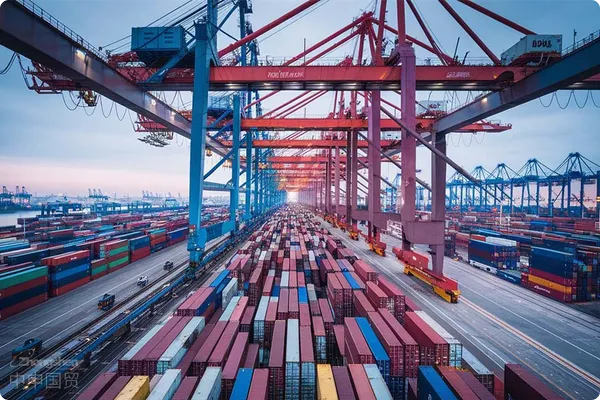

Against the backdrop of global supply chain restructuring in 2025, industrialEquipment ImportsIt is characterized by large single transaction amounts (averaging USD 8.5 million), complex technical parameters (involving 78 international certification standards), and long delivery cycles (averaging 152 days). According to the latest data from the World Customs Organization, the error rate in customs declarations for mechanical equipment products reaches 32.7%, directly causing companies an average annual loss equivalent to 11.3% of the imported goods' value.

Professionalforeign tradeThe Four Core Service Values of Agency

- Accurate Classification of Tariff Schedules

- The accuracy rate of HS Code classification has been improved to 99.8%.

- Utilize the pre-ruling mechanism to lock in tax rates for 3-5 years.

- Dynamic Monitoring of Technical Barriers

- Covering 83 countries' access requirements with real-time updates

- Provide a 120-day advance warning for certification changes.

- Customized Logistics Solution Design

- The transportation cost for special equipment is reduced by 18-25%.

- The customs clearance time has been reduced to 68% of the industry average.

- Closed-loop management of financial risks

- L/CFraud detection accuracy rate: 99.5%

- The exchange rate fluctuation hedging solution covers 90% of the exposure.

Identification and Prevention Strategies for Hidden Costs

A case study of a certain automotive parts manufacturer importing precision machine tools from Germany in 2024 demonstrates that professional agency services can help avoid hidden costs, including:

- 40-day port demurrage loss (USD 287,000) caused by lagging technical standards

- A 7.2% additional tariff (USD 612,000) due to origin determination errors.

- Equipment damage caused by improper transportation reinforcement measures (USD 1.35 million)

Criteria for Selecting Agency Service Providers in 2025

It is recommended that enterprises evaluate potential partners from three dimensions:

- Industry vertical expertise: Service cases in specific equipment fields ≥50

- Global Service Network: The coverage rate of self-owned customs clearance teams in key ports should be ≥75%.

- Risk Control System Certification: Must possess AEO certification and C-TPAT qualification.

Import Process Optimization Roadmap

- Preliminary Due Diligence Phase (30-45 days)

- Supplier Compliance Audit

- Technical Regulation Compliance Verification

- Contract Execution Phase (60-90 days)

- Structured Design of Payment Terms

- Customized Transportation Insurance Plan

- Customs clearance and delivery phase (15-30 days)

- Application of Innovative Models for Customs Duty Guarantees

- On-site installation and debugging support

Special Notes for 2025

According to the WTO's notifications on technical barriers to trade, the new regulatory changes focus on:

- Nine new testing indicators have been added to the industrial robot safety certification.

- The energy efficiency standard for CNC machine tools has been upgraded to EEI 2.0.

- The draft amendment to the EU Machinery Directive 2006/42/EC comes into effect.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912