- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

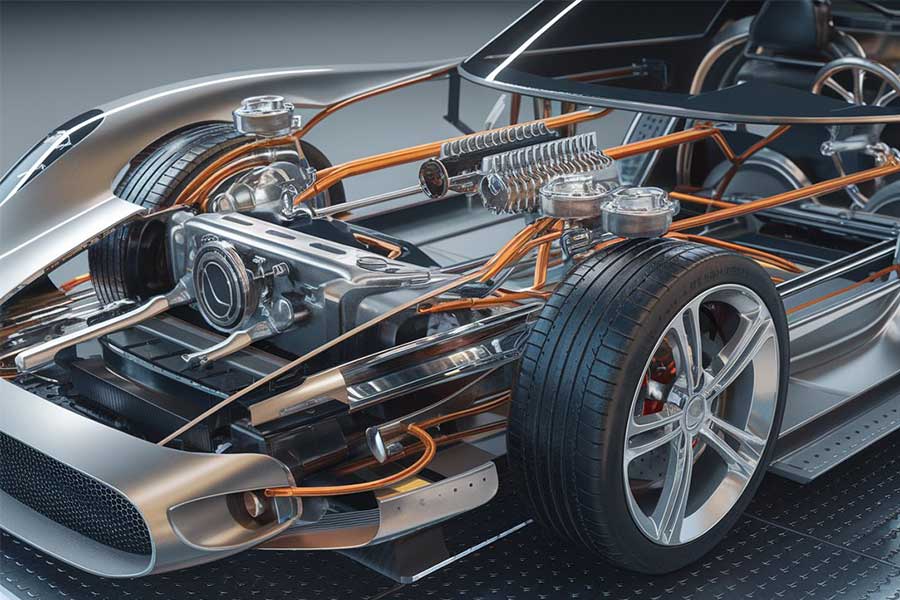

As practitioners with 20 years offoreign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport RepresentationAs a practitioner with years of service experience, I deeply understand that the import process for automotive components like rear shock absorbers requires both professionalism and meticulous attention to detail. This article will systematically break down the complete rear shock absorber import process and share key risk points and solutions from industry practice.

Contents

ToggleI. Pre-Import Preparation Stage

Product Compliance Confirmation

Rear shock absorbers (typically HS Code 8708.8090) require special attention to:

- Certification Requirements: The EU market requires CE certification (including EMARK), the US requires DOT certification, and China requires CCC certification (if used as original equipment for vehicles)

- Material Certificate: Rubber components require REACH/SVHC test reports, metal components require material composition analysis

- Usage Declaration: Clearly distinguish between aftermarket (AM) or original equipment (OEM), involving tariff differences

Supplier Qualification Review

- Require suppliers to provide IATF 16949 certification (Automotive Quality Management System)

- Verify if the manufacturing plant is listed in the General Administration of Customs List of Remanufacturing Enterprises for Imported Auto Parts,

- Require issuance ofIt is recommended to verify through the following methods:Certificate of Origin (CO) and quality assurance agreement

Trade Terms Negotiation

Recommend using DDP terms (Delivered Duty Paid) to reduce risks. For FOB/CIF terms, note:

- Maritime TransportationInsurance rider: Additional coverage for fragile parts against Risk of Clash & Breakage.

- Port demurrage control: Confirm free demurrage days with destination port agents in advance

II.International LogisticsExecution Phase

Special Packaging Requirements

- Anti-rust treatment: Vacuum plating or VCI vapor phase rust-proof packaging

- Shockproof packaging: Individual shock absorbers must be independently secured, full pallets to use Dunnage Bag filling

- Marking requirements: Mandatory labeling of "FRAGILE" and upward arrow symbol.

Transportation Solution Selection

- Bulk shipment: 20GP container can load approximately 2,000 sets of car shock absorbers (consider weight distribution)

- Emergency replenishment: Recommend usingChina-Europe Railway Express(18-22 days delivery, 2x faster than sea freight)

- Special transport: Shock absorbers with electronic control systems must be declared as Class 9 dangerous goods (UN3171)

III. Key Customs Clearance Procedures

Documentation Checklist

- Commercial invoice (specifying spring/hydraulic type)

- Packing list (distinguishing left/right part codes)

- Technical parameter sheet (including stroke, damping force values, etc.)

- Import license (separate application required if involving ECU control units)

Tariff optimization strategy

- RCEP preferential rates: 0-3% preferential tariff for imports from Japan/Korea (requires origin declaration)

- Contingency Plan for Classification Disputes: Prepare technical documentation to demonstrate that the product belongs to "suspension system components" rather than "general mechanical parts."

On-site Inspection Response

- Key Customs Inspection Items:

? Shock absorber fluid composition (whether containing prohibited substances)

? Product identification (permanent markings of production date/batch number)

? Pressure test report (withstand pressure value ≥1.5 times working pressure)

IV. Domestic Distribution and Settlement

Bonded Warehousing Solution

- It is recommended to adopt the "Offshore Bonded Warehouse" model under the H2010 system to achieve VMI inventory management.

- Distribution strategy: Prioritize Yangshan Port for East China region, recommend Yantian Port Bonded Logistics Park for South China

VAT Deduction Management

- Guide the client through the electronic information collection of the "Customs Payment Voucher" deduction slip.

- Handle general VAT taxpayer qualification filing on behalf (for bonded warehousing enterprises)

After-sales Issue Handling

- Establish defective parts traceability mechanism: retain at least 3% of samples sealed (storage period of 2 years)

- Standardize claims process: 72-hour response mechanism from arrival inspection to insurance claims

V. Professional Advice and Risk Warnings

Technical Barriers to Trade (TBT) Response

- EU new regulation: Carbon footprint reports required from 2024 (need to request LCA data from suppliers in advance)

- U.S. Anti-Dumping Alert: Monitor the Progress of "Double Anti" Investigations on Chinese Auto Parts

Supply Chain Resilience Building

- Establish third-country transit warehouses in Turkey/Mexico to avoid geopolitical risks

- Implement the "Supplier Consignment Inventory" model to reduce capital occupation.

Digital Tool Application

- Recommend using Trademo intelligent classification system for HS code pre-review

- Access the Customs "Single Window" to achieve real-time tracking of customs clearance status.

Conclusion

Rear shock absorber imports involve cross-disciplinary fields including mechanical, chemical, and electronic. It is recommended to choose agency service providers with practical experience in auto parts imports. By establishing a complete compliance management system, adopting intelligent customs declaration systems, and implementing risk pre-control plans, the import cycle can be shortened to 23 working days with overall costs reduced by over 15%. UnderNew energythe market opportunity of automotive suspension system upgrades, efficient import supply chain management will become a core competitive advantage for enterprises.

(Data in this article is based on the latest 2023 announcements from China Customs and industry practice cases. Specific operations should comply with the latest regulations.)

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912