- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

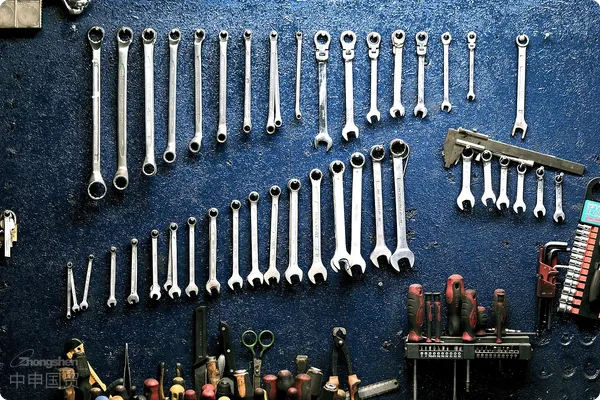

|Hardware & Toolsfor containers exported to the USExhibition Goods Customs Clearance Process Analysis | Professional ImportExport RepresentationGuide|

For domestic hardware tool manufacturers andforeign tradecompanies, participating in U.S. industry exhibitions is a crucial channel for expanding overseas markets. However, exhibition itemsExport Clearanceinvolve complex documentation requirements and customs supervision procedures. Improper handling may result in high port storage fees or even seizure of exhibits. As a professionalimport and exportagency service provider, we outline the following key steps and considerations to help you efficiently complete the customs clearance process.

Contents

TogglePre-Exhibition Preparation Phase (60-90 Days Before Exhibition)

1.Clarify Exhibit Attributes and Purpose

- Please confirm that the exhibits are of a "temporary export" nature (not for sale) and can apply for the ATA Carnet or the U.S. Customs Temporary Importation Bond (TIB) system.

- Note: The U.S. is not a member of the ATA Convention, temporary imports must be declared via CBP Form 3461, with bond payment recommended (typically 110% of goods value)

2.Product classification and compliance certification

- Accurate HS CODE declaration: Common codes for hardware tools (e.g.: 8205.40.00 manual wrenches, 8203.20.00 steel files)

- Complete mandatory certifications:

? FCC certification (for tools containing electronic components)

? UL certification (power tools)

? DOT certification (vehicle tool kits)

? Anti-dumping duty verification (e.g. additional tariffs may apply to specific wrench categories)

3.Document preparation checklist

- Basic documents: Commercial invoice, packing list, bill of ladingAir Transportationform

- Special documents:

? Exhibition booth confirmation letter (containing organizers customs registration number)

? Temporary import bond document (CBP Form 301)

(Preferential tariffs can be enjoyed under ASEAN/China - ROK FTA) It is recommended to verify through the following methods:(COO)

? Product material declaration (MSDS required for tools containing chemicals)

Customs Declaration Process (30 Days Before Exhibition)

1.Customs clearance method selection

- Self-filing: Suitable for companies with U.S. importer qualifications (must submit Importer of Record information)

- Agent filing: Processed through customs-licensed brokers (Customs Broker), requires POA authorization

2.Key electronic filing points

- Submit electronic data via ACE system, with emphasis on:

? Value Declaration: The exhibits must be marked as "No Commercial Value."

? Labeling requirements: Each exhibit must bear the "MADE IN CHINA" country of origin label.

? Wood packaging material treatment (IPPC fumigation certificate required)

3.Customs inspection priorities

- Anti-terrorism check: CBP may require factory security certification (C-TPAT)

- Intellectual property verification: Ensure no patent/trademark infringement risks for tools

- Bond payment: TIB bond can be paid in installments via Duty Deferral Program

Logistics and Customs Clearance Operations (7-15 Days Before Exhibition)

1.Selection of Transportation Solutions

- Air express: Suitable for small-volume high-value exhibits (declared value ≤$800 may use de minimis channel)

- Maritime TransportationFCL: Requires advance FTZ (Free Trade Zone) warehouse booking for temporary storage

- Special note: Avoid using USPS channels as commercial exhibits may be classified as commercial shipments

2.Port Inspection Response Strategies

- Prepare the "Inspection Emergency Kit": including a physical sample catalog, an English version of the test report, and 24-hour contact information for the responsible personnel.

- Common Inspection Reasons:

? Power units not converted to U.S. standards (e.g., watts → horsepower)

? The product description is vague (it should be specified as "adjustable torque ratchet wrench" rather than "hardware tools").

3.Port Demurrage Handling

- Apply for Immediate Delivery: Pay deposit to release goods first, then submit documents later

- Activate Bonded Carrier: Transfer detained goods to customs-bonded warehouses

Key Post-Exhibition Handling Matters

1.Exhibit Return/Resale Decisions

- Re-export Declaration: Can apply for TIB bond refund if re-exported within 6 months

- On-site Sales: Need to pay import duties (calculated at general trade rates) and submit CBP Form 7552

2.Compliance Document Archiving

- Retain customs release records (CBP Form 3461) for at least 5 years

- Update ERP System: Record exhibit flow status to avoid future impactsExport Drawback

Value-Added Benefits of Professional Agency Services

As an AEO-certified import/export service provider, we offer clients:

? Pre-classification Service: Lock HS codes through Binding Rulings

? Bond Optimization: Reduce TIB capital pressure with group guarantee models

? Risk Alert System: Real-time monitoring of U.S. Customs HTSUS code updates

? End-to-End Tracking: GPS visual monitoring from factory loading to exhibition hall delivery

Conclusion

Exhibit customs clearance is essentially a comprehensive game of international trade compliance, timeliness, and cost-effectiveness. We recommend companies start customs preparation 90 days in advance and establish standardized procedures through professional agencies. For customized solutions, contact us for the U.S. Exhibition Logistics Clearance White Paper and HS CODE smart query tool.

(This article isZhongShen International TradeOriginal content by Customs Affairs Department of Import/Export Agency, data updated to August 2023

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912